Onboarding & Data Management

Onboarding

Every new organization follows the same onboarding flow to ensure clean data, consistent financial statements, and reliable analytics. This setup is mandatory and takes only a few minutes.

TL;DR

Upload a trial balance, design your statements, map your accounts. Ready in under 10 minutes.

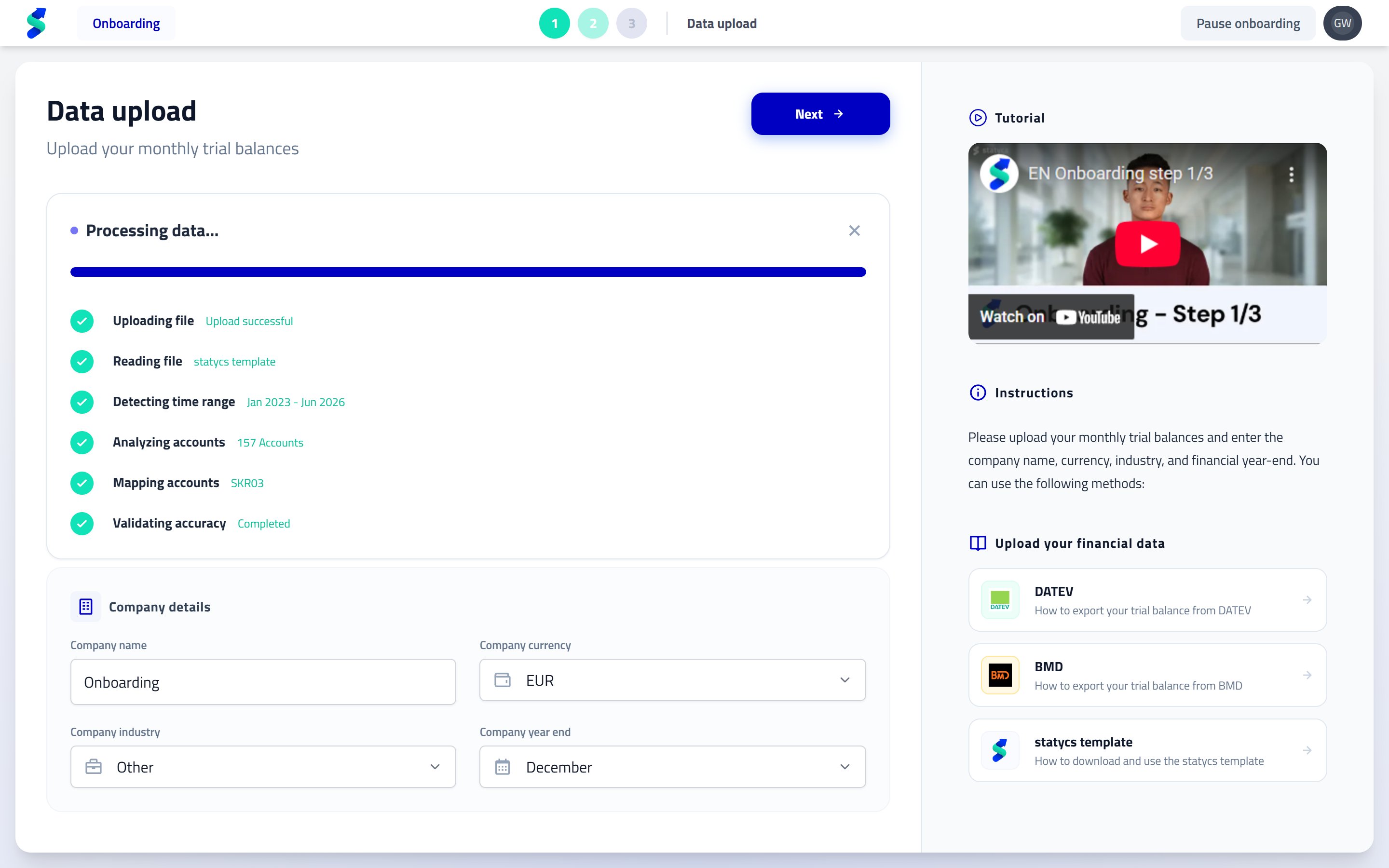

1. Upload Data

What you do

- Upload your trial balance using supported formats

- Define company name, fiscal year-end, industry, and currency

Why it matters

- Standardized imports prevent format and structure issues

- Clear guidance ensures correct exports and templates

Formats & inputs

- Additional input formats and integrations will be added continuously

- The onboarding flow remains the same for all future inputs

Validation

- Unsupported formats trigger an error with clear instructions

- You can only continue once a valid trial balance is detected

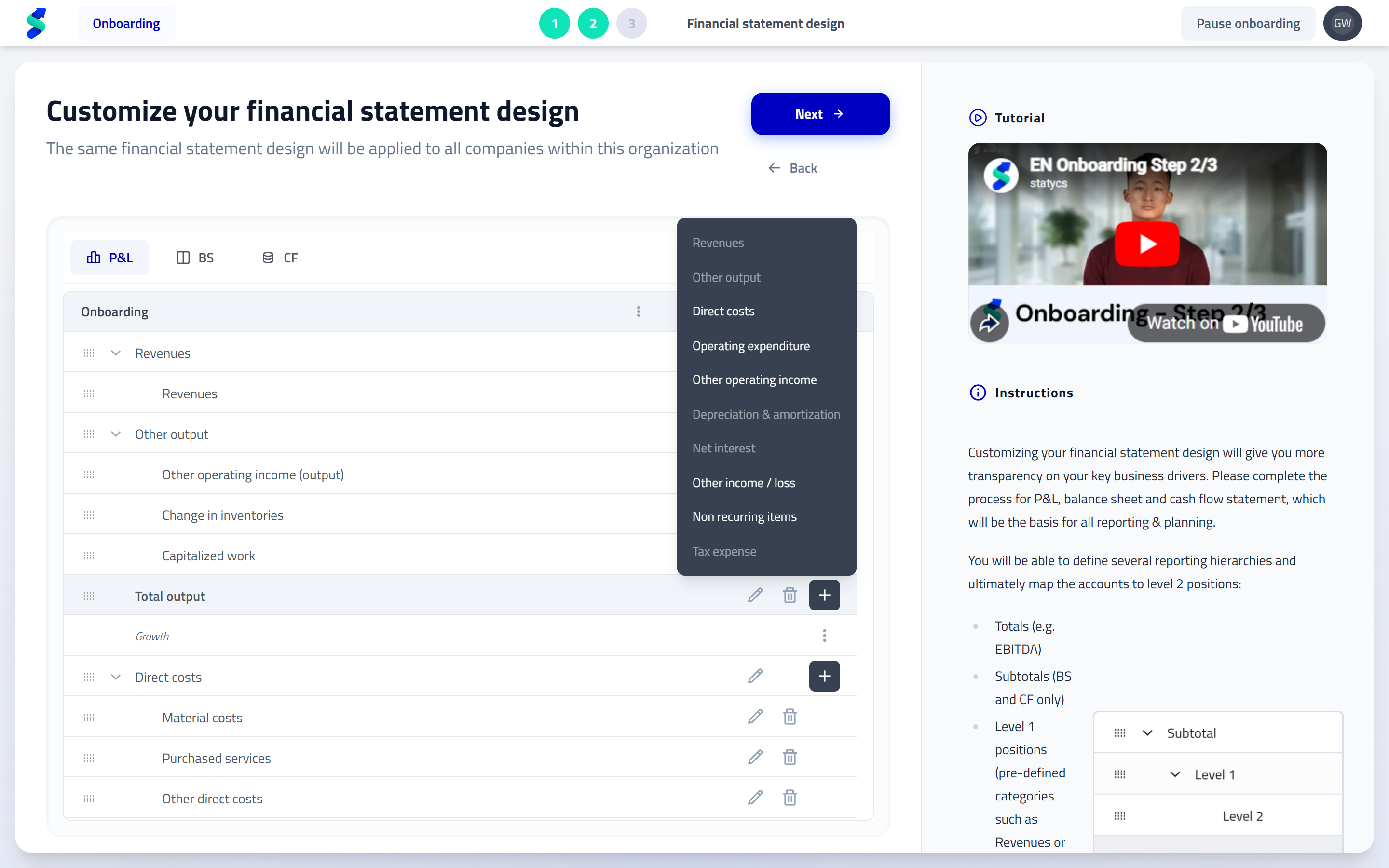

2. Design Financial Statements

What you do

- Define the structure of your P&L, Balance Sheet, and Cash Flow

- Add and arrange Totals, Subtotals, Level 1, and Level 2 positions via drag & drop

- Start from templates or extend the predefined structure

Why it matters

- Reporting reflects your business logic—not your chart of accounts

- A consistent structure enables clean analysis and planning across all companies

You can refine Level 2 positions and account groups later. The goal at this stage is to establish a solid, consistent structure.

Predefined Level 1 positions

Level 1 positions are predefined to ensure standardized financial logic and reliable analytics. These positions cannot be removed.

P&L

- Revenues

- Other Output

- Direct Costs

- Operating Expenditure

- Other Operating Income

- Depreciation & Amortization

- Net Interest

- Other Income / Loss

- Non-recurring Items

- Tax Expense

Balance Sheet

- Fixed Assets

- Inventory

- Trade Receivables

- Other Assets

- Cash & Cash Equivalents

- Equity

- Provisions

- Financial Liabilities

- Trade Payables

- Advance Payments

- Other Liabilities

Level 2 positions and account groups are fully customizable within this structure.

Automatic logic & fixed positions

Certain positions include built-in logic to ensure consistent financial calculations.

- Level 2 positions under Fixed Assets automatically generate CapEx, depreciation, and cash flow entries

- Positions under EBITDA populate “Other Cash Flow” entries

Fixed (non-editable) positions

- EBITDA

- Net Income

- Total Assets

- Total Equity & Liabilities

- Cash & Cash Equivalents

- Retained Earnings / P&L Carryforward

- Non-categorized (placeholder for unmapped accounts)

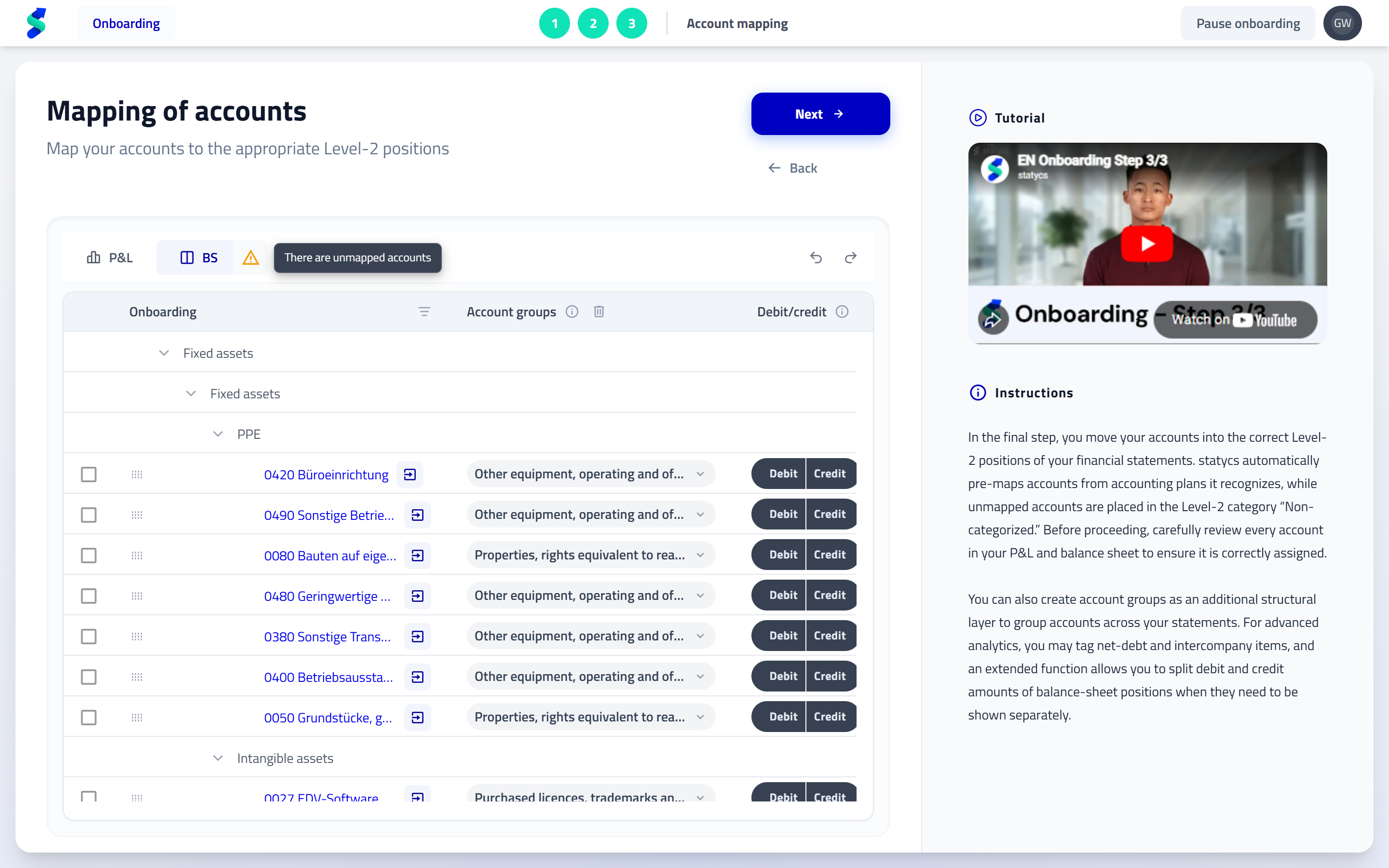

3. Map Accounts

What you do

- Map trial balance accounts to Level 2 positions

- Create account groups as an intermediate structural layer between Level 2 positions and individual accounts

- Review and adjust auto-mapping (supported charts of accounts are recognized)

- Tag net debt and intercompany accounts

- Split debit and credit balances if required (e.g. negative receivables treated as liabilities)

Why it matters

- Automatic mapping reduces setup effort significantly

- Warning indicators immediately highlight unmapped accounts

- Correct structure and tagging prepare your data for analysis, planning, and consolidation

Account groups

Account groups are a structural layer between Level 2 positions and individual accounts.

They improve grouping, enable cleaner analysis, and serve as drivers in planning.

Account groups are reused consistently across Financials, Analysis, and Planning.

Automapping & new uploads

- Standard charts of accounts are mapped automatically

- For previously mapped companies, new uploads that contain new or unknown accounts place those accounts automatically into Non-categorized

- This allows you to immediately identify and map new accounts correctly without affecting existing mappings

- Automapping coverage will be expanded continuously

Data Management

The Data section is used to manage financial structures and company data after onboarding.

It separates shared financial structure from company-specific data to ensure consistency across entities.

It is split into:

- Organizational Data – shared financial statement design

- Company Data – uploads, mappings, and financial values per entity

Organizational Data

Changes made here affect all companies in the organization.

What you do

- Maintain the shared financial statement design

- Ensure consistent Totals, Subtotals, Level 1, and Level 2 positions across entities

Drafts, impact & publishing

- All changes are saved as drafts

- You can review the impact of design changes on financials before publishing

- Click Confirm to apply changes across the organization

Confirming a financial statement design is not reversible.

Translations

- Positions are stored in the language defined in user settings

- Default positions are translated automatically

- Custom positions not yet translated are marked with 🌍︎

- To translate custom positions, switch the language and adjust the financial statement design

Company Data

Company Data affects only the selected company.

It provides a centralized overview of all companies and their data status.

Company overview

For each company, you can see:

- Last sync – when financial data was last updated

- Uploaded time range – which periods are available

- Mapping status – whether unmapped accounts exist

⚠️ A warning indicator highlights companies with unmapped accounts.

From this overview, you can perform three core actions.

1. Upload Data

- Upload or sync trial balances at any time

- New uploads overwrite existing financial values

- The upload process is identical to onboarding

- Additional input formats and integrations will be added continuously

Review before confirm

- You will see the impact of overwritten data before confirming

Confirming an upload overwrite is not reversible.

2. Mapping

- Open Mapping to edit account mappings in draft mode

- Same functionality as during onboarding

- Accounts from new uploads are always placed under Non-categorized

- Users must explicitly review and map new accounts

- Use ⚠️ filters to locate unmapped accounts quickly

- Confirm or revert changes to publish them live

3. Delete Data

- Use Delete Data to remove financial values

from the last uploaded month onward - Designed for corrections and re-uploads

Review before confirm

- You will see the impact of deleted data before confirming

Deleting data is not reversible.

- Financial statement designs are never affected

- Account mappings are only removed if all company data is deleted

Why it matters

- Clear visibility into data health across all companies

- Full transparency before committing irreversible actions

- Full control over uploads, mappings, and financial values per entity